Which is better, pension points or savings? Pension points

Due to recent changes in pension legislation, many people still have an open question about how to calculate pension points. When talking about the size of the insurance pension, a special formula is used where you need to know how many points you have. They are calculated on the basis of contributions, as well as a certain period of retirement.

The age benefit is calculated by multiplying the ratio by the value available on the day payments begin. A fixed component is added to the accrued figure. This pension is paid regardless of the funded part.

Concept

If we talk about what pension points are and how they are calculated, it should be noted that they include units that are formed based on a person’s work activity and depending on salary. To receive it, currently you need not only a certain work experience, which must be at least fifteen years, but also a minimum number of years.

The accrued value has been gradually increasing since 2015, starting from 6.6. Every year the indicator increases by 2.4 until the level of the individual pension coefficient reaches 30. This will happen in 2025.

Why are they used?

The number of pension points affects what insurance payment you will receive. old man. The size is calculated using the following formula:

- old age insurance pension = coefficient * cost of 1 point on the appointed day.

The same formula is used to calculate pensions based on the onset of disability and the loss of a breadwinner.

Calculation

The method of calculation is determined in the relevant law. In this case, the following formula is used:

- number on the day when the pension is assigned = the sum of individual coefficients multiplied by the increasing coefficient.

Peculiarities

The indicator of the value of points before January 1, 2015 = the sum of the ratio of the size of the insurance part, calculated by age, labor - for the onset of disability or loss of a breadwinner until 12/31/2014 to the score estimate as of 01/01/2015 and the ratio of the coefficient by which the insurance pension is calculated for the onset of disability to the coefficient, in connection with which the insurance payment is formed for age, disability and loss of a breadwinner.

To calculate your pension accruals after 2015, you should divide the sum of points from 2015 and the sum of the coefficients for each year by the coefficients for receiving payments for age, disability and loss of a survivor.

It turns out that after the 2015 annual milestone, points depend on what pension contributions the employer makes. This is how the state seeks to encourage workers to seek white wages.

Also interesting in the calculation is the NP coefficient (equal to 1.8), which is used to calculate pension points for a whole year for a time such as:

- emergency service;

- service in law enforcement, fire, drug control, and in the criminal punishment system;

- caring for a disabled person of the 1st group, a person over 80 years old, a disabled child;

- military spouses living with their spouses, where they did not have the opportunity to work, but not more than 5 years;

- residence abroad of spouses sent to consular organizations and on diplomatic missions;

- In terms of how these coefficients are calculated when caring for a child of 1.5 years, not more than 6 years in total, the following indicators have been introduced:

– 1.8 – for the 1st child up to 1.5 years old;

– 3.6 – for the 2nd child up to 1.5 years old;

– 5.4 – for the 3rd or 4th child up to 1.5 years old.

Maximum value

Important! Established by law maximum amount points. The amount is influenced by the year (during the transition period until 2025 they are gradually increased) and also by whether accumulative part or not. For example, to calculate pension points in 2019, you need to take into account the fact that for those who pay contributions, they can be up to 5.26, and for those who do not make these payments, it can be 8.26. But from 2025, for those who pay contributions, the pension point can reach 6.25, and for the rest - 10.00.

In addition, the law introduced increasing coefficients. For insurance benefits for old age and survivors, they are used for:

- first appointment;

- refusal of the old-age pension and further restoration or reappointment;

- receipt upon the loss of a breadwinner who does not apply for an old-age pension after the corresponding right has been transferred to him.

Point cost

The law provides for indexation of both the point unit and the fixed part. So, from the first of February the index increases for the previous year, and from the first of April the difference between the salary index for the year and the adjustment coefficient taking into account the rise in prices for the previous year is calculated. For example, one pension point from April 1 of this year is equal to 78.58 rubles.

If a person does not reach the minimum points by retirement age, he is not paid an insurance pension.

Pensioners may have a question about how, according to the law, points received during the Soviet era are currently counted. Those who are wondering how to calculate these pension points should contact the Pension Fund branch at their place of registration. Then the employee will determine what accruals he will have before and since 2002. For the calculation, a special formula is used that takes into account the length of service during the Soviet period.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!Our lawyer can advise you free of charge - write your question in the form below:

Payments from pension savings funds are assigned and paid in the form or pension payment or .

The pension rights of citizens are formed in individual pension coefficients. All previously formed pension rights were converted without reduction into pension coefficients and are taken into account when assigning an insurance pension.

Conditions for the emergence of the right to insurance pension for old age general conditions are:

- reaching the age of 65 years - for men, 60 years - for women (taking into account the transitional provisions provided for in Appendix 6 to Law No. 400-FZ). Certain categories of citizens have the right to receive an old-age insurance pension early;

- for persons holding government positions in the Russian Federation and government positions in constituent entities of the Russian Federation held on a permanent basis, municipal positions held on a permanent basis, positions in the state civil service of the Russian Federation and municipal service positions - the age specified in Appendix 5 to Law No. 400-FZ . Already in 2017, the process of increasing retirement age for civil servants, six months a year up to 65 years of age (men) and up to 63 years of age (women). From January 1, 2021, the step to increase the retirement age will increase - one year per year. Thus, the retirement age for civil servants is brought into line with the proposal for the rate of increase in the generally established age for everyone.

Moreover, if such persons have insurance experience of at least 42 and 37 years (men and women, respectively), an old-age insurance pension can be assigned to them 24 months before reaching the specified age, but not earlier than reaching the age of 60 and 55 years (men and women, respectively ).

- having at least an insurance period15 years (from 2024) taking into account the transitional provisions of Art. 35 of the Law of December 28, 2013 No. 400-FZ;

- availability of a minimum amount of pension coefficients -at least 30 (from 2025) taking into account the transitional provisions of Art. 35 of the Law of December 28, 2013 No. 400-FZ.

Citizens who are specified in Part 1 of Article 8, paragraphs 19 - 21 of Part 1 of Article 30, paragraph 6 of Part 1 of Article 32 of Law N 400-FZ "On Insurance Pensions" and who, in the period from January 1, 2019 to December 31, 2020, have achieved age giving the right to an old-age insurance pension (including its early assignment) in accordance with the legislation of the Russian Federation in force before January 1, 2019, or have acquired the length of service in the relevant types of work required for early appointment pensions, old-age insurance pension may be assigned before reaching the age or the onset of the deadlines provided, respectively, by Appendices 6 and 7 to the said Federal Law, but no more than six months before reaching such an age or the onset of such deadlines.

The number of pension coefficients depends on accrued and paid insurance contributions to the compulsory pension insurance system and the length of insurance (work) experience.

For each year of a citizen’s labor activity, subject to the accrual of insurance contributions for compulsory pension insurance by employers or personally paid by him/her, he or she is formed pension rights in the form of pensions.

The maximum number of pension coefficients per year from 2021 is 10, in 2019 - 9.13.

How many pension coefficients

can be charged to you for 2019?

Enter your monthly amount

wages before personal income tax:

Error! Enter a salary higher than minimum size wages in the Russian Federation in 2019 - 11,280 rubles.

Calculation results

Number of pension points

per year: 7.83

Option pension provision in the compulsory pension insurance system affects the calculation of annual pension coefficients. When forming only an insurance pension, the maximum number of annual pension coefficients is 10, since all insurance contributions are directed towards the formation of an insurance pension. When choosing a formation, both insurance and funded pension the maximum number of annual pension coefficients is 6.25.

Citizens born in 1967 and younger who, before December 31, 2015, chose to form an insurance and funded pension in the compulsory pension system can at any time refuse to form a funded pension and direct 6% of insurance contributions to form only an insurance pension.

Also, citizens born in 1967 and younger, in whose favor insurance contributions for compulsory pension insurance will begin to be accrued by the employer for the first time after January 1, 2014, are given the opportunity to choose a pension provision option (form only an insurance pension or form both an insurance pension and a funded pension) within five years from the date of first accrual of insurance premiums. If a citizen has not reached the age of 23, the specified period is extended until the end of the year in which he turns 23.

When choosing a pension option, you should take into account that the insurance pension is guaranteed to be increased by the state through annual indexation. Funds from the funded pension are invested in the financial market by the chosen citizen of NPF or UK. The profitability of pension savings depends on the results of their investment, that is, there may be a loss from their investment. In this case, only the amount of insurance premiums paid is guaranteed for payment. Pension savings are not indexed.

All citizens born in 1966 and older have a pension option - the formation of only an insurance pension.

Obtaining the right to an insurance pension depends on the year the insurance pension was assigned

|

Minimum insurance period |

Minimum amount of individual pension coefficients |

Maximum value of the annual individual pension coefficient |

||

|

in case of refusal to form a funded pension |

when forming a funded pension |

|||

|

2025 and later |

||||

*From 2015 to 2020, regardless of the choice of pension option in the compulsory pension system, all citizens will only have pension rights. In this regard, the maximum value of the annual individual pension coefficient is the same for any pension formation option.

The old-age insurance pension is calculated using the formula:

INSURANCE PENSION = THE SUM OF YOUR PENSION COEFFICIENTS* COST OF THE PENSION COEFFICIENT as of the date of pension + FIXED PAYMENT

SP = IPC * SIPC + FV , Where:

- JV - insurance pension

- IPC - this is the sum of all pension coefficients accrued on the date of assignment of an insurance pension to a citizen

- SIPC - the value of the pension coefficient on the date of assignment of the insurance pension.

When assigning a pension from 01/01/2019 = 87.24 rubles. Indexed annually by the state.

- FV - fixed payment.

Thus, the calculation of the insurance pension in 2019 is carried out according to the formula:

SP = IPK * 87.24 + 5334.19

Also, the amount of your pension coefficients (IPC) is significantly increased by applying for an old-age insurance pension for the first time (including ahead of schedule) after the right to it arises. For each year of later application for a pension, the insurance pension will increase by the corresponding premium coefficients.

For example, if you apply for a pension 5 years after reaching retirement age, the fixed payment will increase by 36%, and the sum of your individual pension coefficients will increase by 45%; and if after 10 years, then the fixed payment will increase by 2.11 times, and the sum of your individual pension coefficients by 2.32 times.

What is a pension point and how to correctly calculate your pension points in 2018? A clear example of calculating a pension point. What are the maximum points that can be counted toward retirement?

How to correctly calculate your pension points in 2018: a clear example of calculating a point for calculating a pension

Just over the past few decades, our pension legislation has become so complicated that it seems much easier to prove Fermat’s theorem than to calculate your own pension. A number of mysteries of the pension system were significantly expanded with the introduction of a new pension formula in 2015, when the transition to a points system was announced pension calculation.

What is a “pension point” and how can it be calculated?

The term itself pension point" is not used in the law; it came into use at the suggestion of the Ministry of Labor in order to more easily convey to the public the system of the new calculation of pensions. The law instead of " pension point“operates with the complex term “individual pension coefficient” (IPC), in essence it is the same thing.

By new formula the pension consists of the sum of these same IPC, to which is added an equal amount of a fixed payment for everyone. That is, the main influence on the size of the pension is exerted by “ pension points ": the more there are, the higher the pension.

« Pension points » are calculated separately for periods of work before January 1, 2015 (when the new formula was introduced) and after.

That is, everything that we had developed before 2015 does not disappear, but is transferred to “ pension points ": the value is determined pension capital according to the rules of the old law and is divided by the cost of one pension point as of January 1, 2015 (64.10 rubles). We get how much pension points we started working until 2015.

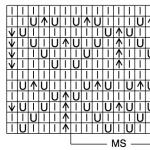

Starting from 2015, pension points are awarded for every calendar year experience using this method

But starting from 2015, pension points are accrued for each calendar year of service according to the following methodology:

- the amount of all insurance premiums accrued to the citizen for the year is taken,

- divided by the maximum allowable insurance premiums for the same year.

The maximum is calculated as follows:

- the maximum base for calculating insurance premiums, approved for the corresponding year, is multiplied by 16% (the general tariff for calculating insurance premiums for an insurance pension).

- the resulting quotient from division is multiplied by 10 and rounded to three decimal places. This is your " pension point " in a year.

However, not any amount is taken into account when calculating the pension. pension point ».

The law provides for the maximum values of “points” that can be taken into account towards a pension:

- for 2015 – 7.39,

- for 2016 – 7.83,

- for 2017 – 8.26;

- for 2018 – 8.70;

- for 2019 – 9.13;

- for 2020 – 9.57.

From 2021, a permanent maximum “pension point” of 10 will be introduced.

The law provides for maximum values of “points” that can be taken into account towards a pension

The law provides for maximum values of “points” that can be taken into account towards a pension Here is a clear example of calculating a “pension point”:

The employee's salary is 20,000 rubles per month. In 2017, he earned 240,000 rubles, respectively. At a 16% rate, he will be charged 38,400 rubles in insurance premiums from this earnings.

For 2017, the maximum base for calculating insurance contributions for compulsory pension insurance was approved in the amount of 876,000 rubles. Therefore, the maximum amount of insurance premiums for 2017: 876,000 x 16%, i.e. 140,160 rubles.

We calculate the pension point: (38,400 / 140,160) x 10 = 2.740.

We compare it with the maximum value of the pension point for 2017: 8.26. The maximum was not exceeded, therefore, the employee’s pension score for 2017 was 2.740.

As you can see, since 2015, calculating the “pension point” is not so complicated; you just need to know the amount of insurance contributions accrued for the year. You can find out by ordering an extract from your personal account from the Pension Fund of the Russian Federation or on the government services website.

In 2018, to qualify for an old-age insurance pension, you need to score at least 13.8 " pension points ».

Video: Calculation of pension points

Over the years, the system of calculation and payment of pensions in the Russian Federation has undergone many changes. One of the radical steps aimed at improving and modernizing it is the introduction of points. The procedure for calculating insurance benefits using individual coefficients (IPC) simplifies the process, but at the same time complicates it. All citizens who worked for the benefit of the USSR, upon entering their well-deserved retirement, will have their pension points calculated for the Soviet period.

The process is further complicated by secondary factors, for example, the difficulty in providing evidence of the presence length of service, its duration, the nature of the work performed, the amount of wages received, etc. During the mentioned period of time, all important information was recorded on paper, and documents, like any things, tend to get lost and spoiled. The translation of pension rights for the Soviet and post-Soviet period into individual coefficients has many nuances. When calculating the IPC, very It is important to divide the working time of persons:

- before 1991;

- until 2002;

- after 2002.

Today, the formula for calculating the amount of insurance benefits consists of:

- individual part- depends on the duration of work, the number of IPCs, etc.;

- fixed payment- the amount of monetary accrual established by law.

In accordance with Federal Law No. 400, the calculation of insurance benefits is based on the duration of work of citizens, the number of individual coefficients earned, as well as the price of one individual industrial complex at the time of pension assignment. But what to do if the future pensioner worked in the USSR for half of his life? How are pension points calculated for service during the Soviet period? This issue is regulated by Federal Law 173-FZ (provisions that do not contradict the current legislation of the country).

Size

Based on the above-mentioned law, to transfer the USSR experience into the IPC, the basic principles for calculating the estimated pension are used, for which, in turn, the following indicators influence:

- time of work until 2002;

- duration of work until 1991;

- average salary for a certain period of time (until 2002).

How are pension points for Soviet experience (period of work in the USSR) calculated? To calculate the IPC, you need to perform several operations.

- for women: if the duration of work is less than 20 years - 0.55, if the length of work is more than 20 years - 0.55 * 0.1 (for each additional year of employment above the norm established by law);

- for men: if the duration of work is no less than 25 years - 0.55 * 0.1, if the time of employment at the enterprise does not reach 25 years - 0.55.

The value of this coefficient is limited by law: it should not be higher than 0.75. In other words, in cases where the calculation of this indicator results in an amount higher than the specified figure, 0.75 is taken into account.

2. Calculate the ratio of average monthly earnings a pensioner, based on the amount of his salary received for a certain period and the average level of average monthly earnings in the Russian Federation for the same time. The following formula will help determine this ratio:

A=B/C, where:

A- average earnings coefficient;

IN- the amount of remuneration received by the citizen for work;

WITH- the level of average monthly wages in Russia for a certain period of time.

The value of this ratio is limited at the legislative level: the maximum indicator is 1.2, except in cases provided for by regulations of the Russian Federation (for residents of the Far North and equivalent territories, a different calculation procedure may be established).

3. Determine the amount of the estimated benefit. In accordance with the legislation of the Russian Federation, it is defined as follows:

A (for 2002) = B*C*1671 - 450, where:

A - the amount of the estimated pension;

B - experience coefficient;

C is the ratio of the average monthly earnings of a pensioner;

number 1671- average monthly salary in the Russian Federation for the period from July 1, 2001 to September 30, 2001;

number 450- the amount of the basic part of the labor benefit established for 2002.

The minimum amount of the calculated pension is determined by law: 660 rubles.

4. Calculate the amount of valorization. To take into account the duration of work until 1991, the legislation established a procedure for a one-time increase in the pension rights of citizens for 2002: 10% of the calculation amount. For each year of work activity before the collapse of the USSR, the person is additionally charged 1%. The definition of the valorization indicator will look like this:

A=B(for 2002)*(0.1+0.01*duration of work until 1991), where:

A- size of one-time increase;

IN- estimated pension.

5. Calculate the amount of benefits as of 2015(an increase was made to the capital for calculating payments from 2002 to 2015).

A = (B for 2001 + C)*5.6148 rubles, where:

A- amount of accruals;

IN- estimated pension;

WITH- amount of valorization;

the number 5.6148 is the amount of indexation of the total amount of insurance premiums.

A=B/64.1, where:

A- number of individual coefficients;

IN- the amount of part of the insurance benefit until 2002;

number 64.1- cost of one coefficient for 2015.

Calculation example

Having learned how pension points are calculated for the Soviet period in theory, you should consider this issue using an example. Citizen Petrov has 40 years of work experience, 20 of which were employed during the USSR and post-Soviet times until 2002:

- 10 years of work at a porcelain factory (from 1981 to 1991);

- 10 years of activity in a furniture factory (from 1991 to 2001).

1. Establishing the length of service indicator: 0.55 + 0.1 x (35 – 20) = 0.70;

2. Calculating the amount of the estimated pension: 0.70 * 1.2 * 1671-450 = 773.2 rubles;

3. Determination of the size of a one-time increase: 1% for each working year in the USSR + 10% (for employment in post-Soviet times) = 154.6 rubles;

4. Allocation of part of the insurance benefit: 773.2+154.6*5.6148=5209.41;

5. IPC calculations: 5209.41/64.1= 81.27.

Methods of obtaining

The IPC is calculated when applying for old-age insurance benefits or on preferential terms. Find out the earned number of individual indicators you can do this in the following ways:

- independently (using the information provided above);

- contact your local Pension Fund office;

- use a special online calculator.

In cases where, when calculating the amount of the insurance benefit, periods of work experience in the USSR were not taken into account, the person has the right to contact the territorial branch of the Pension Fund of the Russian Federation with a corresponding application to eliminate this problem. The form of such a document is freely available on the official Internet page of the Pension Fund.

The pension system in Russia has undergone several major changes in recent years. Significant adjustments were made in 2015, when pensions began to be calculated using a new formula, taking into account the so-called individual pension coefficient (IPC), which is also called a pension point. Several years have passed, but the pension points system continues to raise many questions: it is not entirely clear who it concerns and how the points are calculated.

Let us tell you in more detail what a pension point is (also known as a coefficient), from what year points are awarded, how much they cost in rubles in 2018, and what the table of pension points looks like by year.

How are pensions assigned and calculated?

Russia has a pension insurance system, which consists of two parts - funded and insurance pensions. Everyone who is officially employed simultaneously earns savings and an insurance pension. Pension savings can be received in a lump sum upon reaching retirement age or in payments at specified intervals. An insurance pension is provided for old age, disability, and loss of a breadwinner. To get it, recently you need to have the required number of points. Otherwise, the insurance pension will be denied even after reaching retirement age:

- 55 years – for women;

- 60 years – for men.

According to the Pension Fund of the Russian Federation, in 2017, about 45 thousand Russians were unable to receive an insurance pension due to a lack of points or length of service. The Pension Fund of Russia offered them to continue working or agree to social pension, the amount of which is much lower than the insurance one.

How many pension points do you need in 2018?

Today, when applying for a pension, the length of service must be at least 9 years, and the number of points must be 13.8. Then, gradually, the duration of the required experience and the number of points required will increase until by 2024 they reach 15 years (for experience) and 30 (for points). These standards were established by Federal Law No. 400 of December 28, 2013.

The bottom line: how to calculate pension points?

All rights that citizens had before the coefficients were introduced are recalculated into points without reduction or reduction and are included in pension calculations. The higher the official salary and the more years a person has devoted to work, the higher the score will be, and with it the pension. The coefficient is formed throughout the citizen’s employment and depends on two main indicators:

- The amount of official earnings from which the amount of contributions paid to the Pension Fund by the employer is calculated.

- Work experience.

There is a third indicator: the fact of applying for a pension. The later a person applies, the higher his score will be. At the same time, the maximum number of pension points per year is limited:

- in 2017 - 8.26;

- in 2018 - 8.70;

- from 2021 - 10.

How much is one point worth?

In 2018, for a citizen retiring, all acquired points are multiplied by the value of the pension point in 2018 (the year the pension was assigned). From this the individual part of the insurance pension is obtained. But there is a second part - a fixed payment, the same for everyone. Their sum is the amount of the pension. There are categories of people who are entitled to increased pay (those with dependents, disabled people of group 1, people over 80, etc.).

The amount of the total fixed payment as of 01/01/2018 is 4,982.90 rubles. Increasing coefficients or indices are also applied in specified cases.

One pension point in rubles in 2018 costs 81 rubles 49 kopecks (Article 5 of the Federal Law of December 28, 2017 N 420-FZ). Its cost is indexed annually from February 1, taking into account the consumer price growth index for the past calendar year.

How to correctly calculate the value of points and the amount of pension?

In order not to make mistakes in the calculations, since they are complex, you can directly contact the Pension Fund. But electronic services greatly simplify the situation. The Pension Fund website has a convenient pension points calculator, which allows you to instantly get the result after filling out the required columns.

To do this, you need to register a personal account for yourself using the link: https://es.pfrf.ru/inquiry/szi6/. The service is available to everyone who has already received an identification record on the unified government services portal.

Pension points by year

Points have been awarded since January 1, 2015, when this innovation was introduced into the Russian pension system. Labor activity until 2015, it is also taken into account and converted into points, including the so-called “social periods”, when a citizen:

- was on maternity leave;

- served in the armed forces;

- cared for an elderly citizen (over 80 years old), a disabled person of group 1 or a disabled child.

Points for these social periods are taken into account if the citizen was employed before or after them. The final value is divided by the cost of 1 point for 2015, when it was equal to 64.10 rubles.

Below are pension points by year (table), which clearly demonstrate how the requirements for persons applying for a pension will change.